Follow JDStrategic on all major social media platforms for daily updates. Click any of the images above to be brought directly to our pages. Tune in to the 'Conquer the Mind' podcast on YouTube for insightful discussions and expert advice.

Financing Options

We have partnered with FranFund and Benetrends Financial, providing a full-service solution to start or grow your business.

Financing is going to be one of the most important components to start your business. We will be here to guide you through this process. We have partnered with FranFund which designs smart all-in-one funding plans that grow with your franchise.

Why Funding?

These firms consistently receive 5-star reviews and take immense pride in providing the best solutions for their clients. They are among the most well-respected names in franchising.

FranFund is recognized as a top funding supplier by Entrepreneur. They are founded by an industry veteran with first-hand experience as a franchise owner, franchise developer and new franchise creator. They specialize in funding solutions for franchises. You will have a dedicated consultant with you to navigate the best solution that suits your needs.

FranFund understands that everyone has a unique financial situation and one cookie-cutter solution will not work for everyone. We offer a wide-range of solutions ranging from 401(k) rollovers to loans. You will clearly understand all the available options to make an informed financial decision.

Join over 30,000 entrepreneurs who have turned their dreams into reality with their help. Become part of their thriving community of successful business owners and let's write your success story together with Benetrends Financial.

They are experts in innovative funding. Not only do they offer ROBS (Rollover as Business Startup) funding, but they also pioneered the concept nearly 40 years ago with their Rainmaker Plan®. While competitors may offer similar funding solutions, only Benetrends brings the extensive experience of helping tens of thousands of entrepreneurs.

What Are The Steps To Get Started?

Tell us about yourself.

Complete an initial survey so FranFund and Benetrends Financial can begin looking at strategies even before your consultation call. You will then schedule a consultation.

Explore your options.

You will speak to a funding consultant to learn about your options, including SBA Loans and 401(k)/IRA Rollover Funding plans like FranPlan® and Benetrends' Rainmaker Plan®.

Receive pre-approval.

Based on proprietary franchise-specific reports, FranFund's FranScore® and Benetrends' extensive evaluation process, you will receive a free pre-approval letter, providing more accurate results for franchisees.

They can move your money and have it ready to go when you decide to move forward, with nothing to undo if your plans change.

Get funded.

Our experienced in-house lending teams will provide extensive guidance in packaging your loan. Once complete, they will shop your loan to their portfolios of lenders to get you the best deal.

Both teams will structure your funding plan and move your tax-deferred and penalty-free retirement funds to your new business.

What Are The Most Common Methods Of Financing?

SBA Loans - Free Pre-Qualification

Includes:

Free consultation with a Lending Expert (team includes ex-bankers who know how to get the best deals on loans!)

Soft credit pull that won’t affect your credit

Pre-approval letter outlining your pre-qualification that you can present to your franchisor or potential landlord

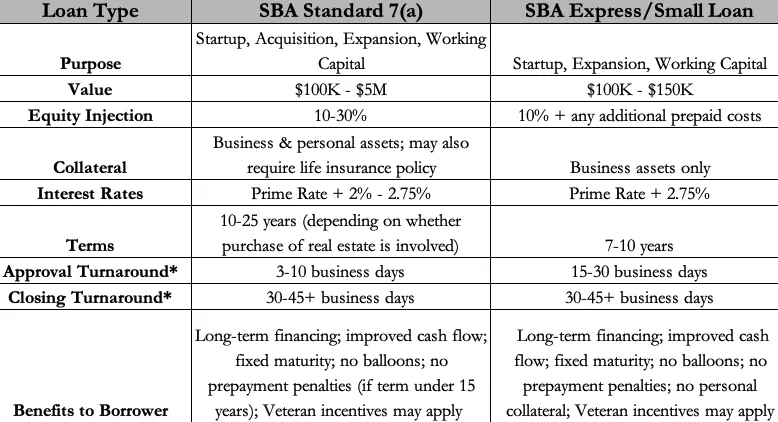

*Average time frames. Based on the complexity of the loan package and the timeliness of required documentation submission, time frames may be less or more.

401(k)/IRA Rollover

Utilizing the IRS’ Rollover for Business Startups (ROBS) program. This allows you to access your retirement savings tax-deferred and penalty free to invest in your business. This is an excellent option for those looking for a funding solution that doesn’t create any debt. They also have their own in-house Third Party Administration Department available to consult and assist you with the ongoing compliance and maintenance obligations associated.

Are you ready to explore opportunities?

Are you ready to control your future?

Are you ready to call yourself a business owner?

Instagram

Youtube

LinkedIn

X

TikTok

Facebook